Learn how transaction fees will change with EIP-1559.

EIP-1559 will change Ethereum’s market mechanisms to pay for transaction fees. Fundamentally, EIP-1559 gets rid of the first-price auction and replaces it with a fixed-price sale. The significance of this change is that people submitting transactions won’t have to guess as much about how much gas is required, as there will be an explicitly ‘base fee’ to be included in the next block. For users or applications that want to prioritize their transaction, they can add a “tip” to pay a miner. You can read about EIP-1559 and how it will change Ethereum in more detail here.

EIP-1559 burns the ETH spent as base fee of the transaction fee. That ETH is removed from the supply. Under EIP-1559, ETH becomes more scarce, as all transactions on Ethereum burn some amount of ETH.

Modeling exactly how deflationary EIP-1559 is difficult since you have to project variables like expected transactions, and, even harder to predict, expected network congestion. In theory, the more transactions that occur, the more deflationary pressure that the burning of the base fee will have on the overall Ethereum supply. The ETH supply may deflate more or inflate more at different times based upon the number of transactions that happen on the network

After the merge to Proof of Stake, Justin Drake's model estimates as a “best guess” that 1,000 ETH will be issued per day, and 6,000 ETH would be burned. Assuming more validators join and the staking APR is 6.7%, the annual supply change will be -1.6million ETH, reducing the annual supply rate by 1.4%.

Despite growing awareness of MEV and potential EIPs to bring more transparency, we can expect arbitrage opportunities to only get more sophisticated as institutional financial traders use DeFi protocols. This could mean that there may end up being way more spent on tips per block than the base fee. Zhu Su and Hasu actually predict that less than half of today's fees could be burned by EIP 1559.

You can track that here.

The idea is to make gas fees more or less transparent for the user. Therefore, wallets will be able to have better estimates and make transaction fees more predictable. They won’t have to rely much on external oracles since the base fee is managed by the protocol itself. There will be additional user experience benefits like automating the fee bidding mechanism, thus reducing delays in transaction confirmation.

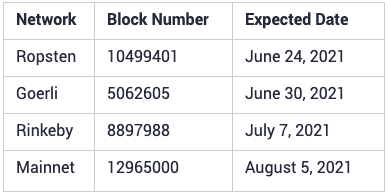

EIP-1559 will be live on Ethereum mainnet on August 5th, which is when we will start rolling out this change. Currently it’s available in Ropsten, Rinkeby, Goerli networks.

No, this is not the intent of the EIP. As a side effect of a more predictable base fee, EIP-1559 may lead to some reduction in gas prices if we assume that fee predictability means users will overpay for gas less frequently. With EIP-1559, the base fee will increase and decrease by 12.5% after blocks are more than 50% full. For example, if a block is 100% full the base fee increases by 12.5%; if it is 50% full the base fee will be the same; if it is 0% full the base fee would decrease by 12.5%.

The ongoing movement of applications to rollups and Layer 2s will greatly reduce fees.

MetaMask will provide you with three options when setting the gas fee:

You will be able to choose between a high, medium or low gas fee. See question above for what these mean. Additionally, you can edit your gas limit, priority fee and max fee in the “Advanced Options” setting. This will override the setting of low, medium or high that was “recommended" for you by MetaMask.

This remains unknown for now. The prediction is the transactions will go through faster because of the gas fee predictability.

Gas fees are determined by how full the block is. EIP-1559 establishes the market rate for transaction inclusion and allows Ethereum to have double the blockspace (by increasing max gas limit per block from 12.5M to 25M). It then targets blocks to only be 50% full.

When the network is >50% utilization, the base fee is increased

When the network is <50% utilization, the base fee is decreased

Over time, Ethereum’s block size will average out to be the same exact size, but this extra capacity allows for flexibility with transaction inclusion. In essence, it will eliminate the extra step in setting the gas price to make a transaction.

No, MetaMask uses a compilation of gas estimation oracles similar to how other wallets estimate gas price. We are confident we can offer competitive gas estimations.

The estimated gas fee is a range. The upper bound of this range is the maximum the user will be paying for a transaction. After the launch of EIP-1559, we should be able to analyze our transaction inclusion rate from our gas estimation range.

MetaMask will have three options to set a gas fee: high, medium and low (more details in FAQ above “How do I set the right gas fee?”) and will preselect the fee we think is relevant to your transaction type. You can change this if you prefer, but we provide the best recommendation. For time-sensitive transactions such as Swaps, we recommend and will pre-select a “high” gas fee.

Refer to our Glossary for detailed definitions about (new) terms.

You can view the transaction activity for the estimated gas fee paid, or view the “effectiveGasPrice” in the transaction receipt on block explorers like Etherscan.

Yes you can but there is the possibility that other transactions (that do include a priority fee) will be prioritized as miners are incentivized to include transactions with a priority fee.

The “tip” will be included as the overall “gas fee” that users see to submit a transaction. You will also be able to “edit gas fee” to increase or decrease the “tip” which is called a “priority fee.”

Most of the tooling will be updated accordingly to show the new information related to the EIP. There will now be an “effectiveGasPrice” in the transaction receipt, which returns the price paid post-execution by the transaction (i.e. base fee + priority fee).

Trezor and Ledger do not yet support EIP-1559 so MetaMask will fall back to pre EIP-1559 gas controls.

If the dapps haven't switched over to the new EIP-1559 fields, MetaMask will detect this and use gasPrice as maxFeePerGas. This means the user will potentially overpay for their transaction.

This will differ per wallet. The idea is to make fees based on block demand more transparent for the user. Wallets like MetaMask will be able to have better estimates, and won’t have to rely much on external oracles since the base fee is managed by the protocol itself. Additionally, when using MetaMask, you can decide between high, medium or low gas fees. Although the recommended type will be pre-selected, the user can change this before confirming the transaction. Additionally, users can change the max fee, max priority fee, and Gwei in the “Advanced” settings. Doing this will override the initial high, medium, or low settings.

During periods of high network congestion, the base fee will adjust by 12.5% depending how much demand surpasses the ideal gas limit per block until that demand abates. Instead of a first-price auction, users will have a better sense of how congested the network is by how high the base fee is. If it is too congested, the user can either pay that price or not, like they would buy an item at a store. Or, they submit a lower fee and wait for the price to go down in the future.

We recommend both dapp developers and networks to switch to EIP-1559 fields and block headers respectively as soon as the London fork happens. If not, the legacy gasPrice will be used as maxFeePerGas, which means that the user will potentially overpay for their transaction.

You can read through the EIP-1559 specifications and also look through the EIP-1559 sections from Ethereum's JSON-RPC specs.

It's both. The user interfaces with the Ethereum network through a client (wallet). Users can also interface with the network through a dapp. In the case that the dapp hasn’t switched over to the new EIP-1559 fields, MetaMask will detect this and show pre-1559 gas estimation UIs.

MetaMask.

Yes, client specifications have been frozen. The London Hard Fork release schedule is as follows:

A: All change is risky, but the Ethereum community has a track record of strong software development and coordination. There are some potential risks EIP-1559 presents to network actors that are sensitive to timing, such as oracles. Oracles usually provide the pricing information needed to support various actors in the DeFi ecosystem. For example, Compound needs to know the valuation (i.e. price x number of assets) of a user's collateral in order to determine if their position needs to be liquidated or not. The valuation of these assets have to be constantly updated, and Compound relies on oracles to update this information. More information about this can be found in this article.

The technical changes for EIP-1559 (and EIP-3198) that may impact your project include a new block format, a new transaction format, the new values for selecting a gas price, a new JSON RPC call and changed behaviour for several JSON RPC calls. For details about these changes, refer to this Infura blog post.

Sources: